Banco de Loja is a financial institution with over 50 years in the Ecuadorian market. While trusted by its business clients, its digital banking platform had not evolved at the same pace as user expectations, resulting in a complex and outdated experience for business users who rely on efficiency and clarity.

Banco de Loja’s business banking platform did not support the speed, clarity, and autonomy that business users need to manage daily financial operations efficiently.

This resulted in:

Redesign the business banking experience to enable fast, clear, and secure self-service operations, allowing business users to manage their finances digitally with confidence and minimal friction.

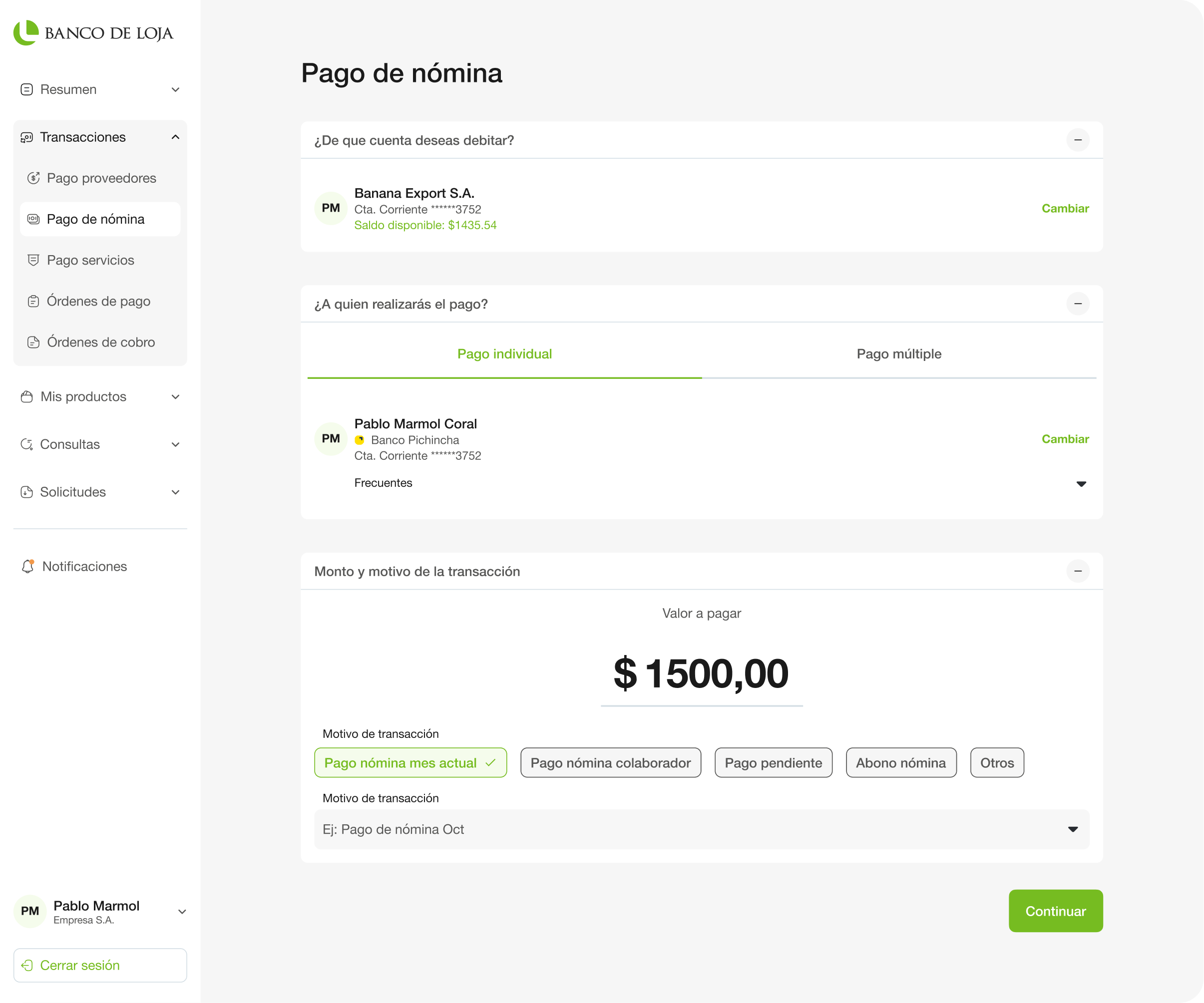

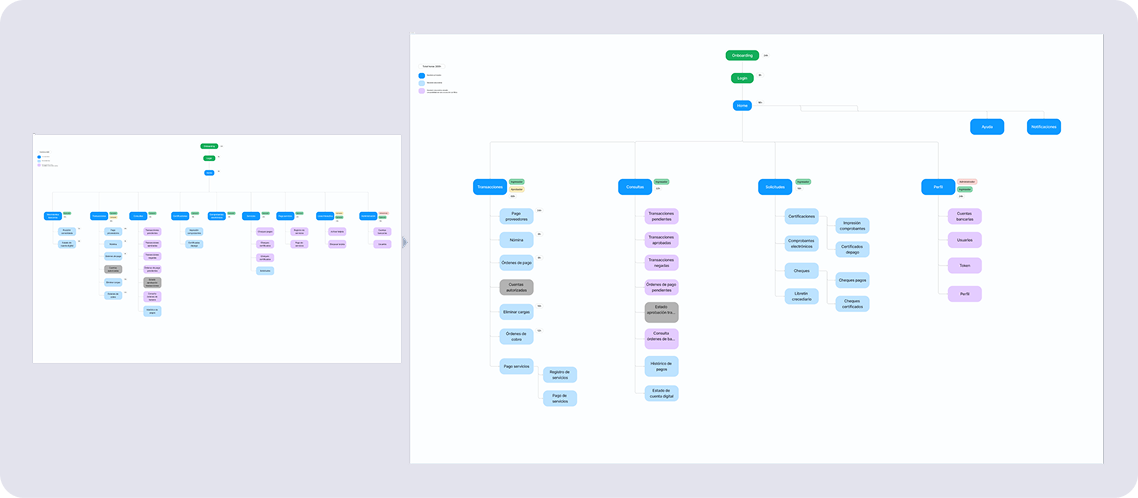

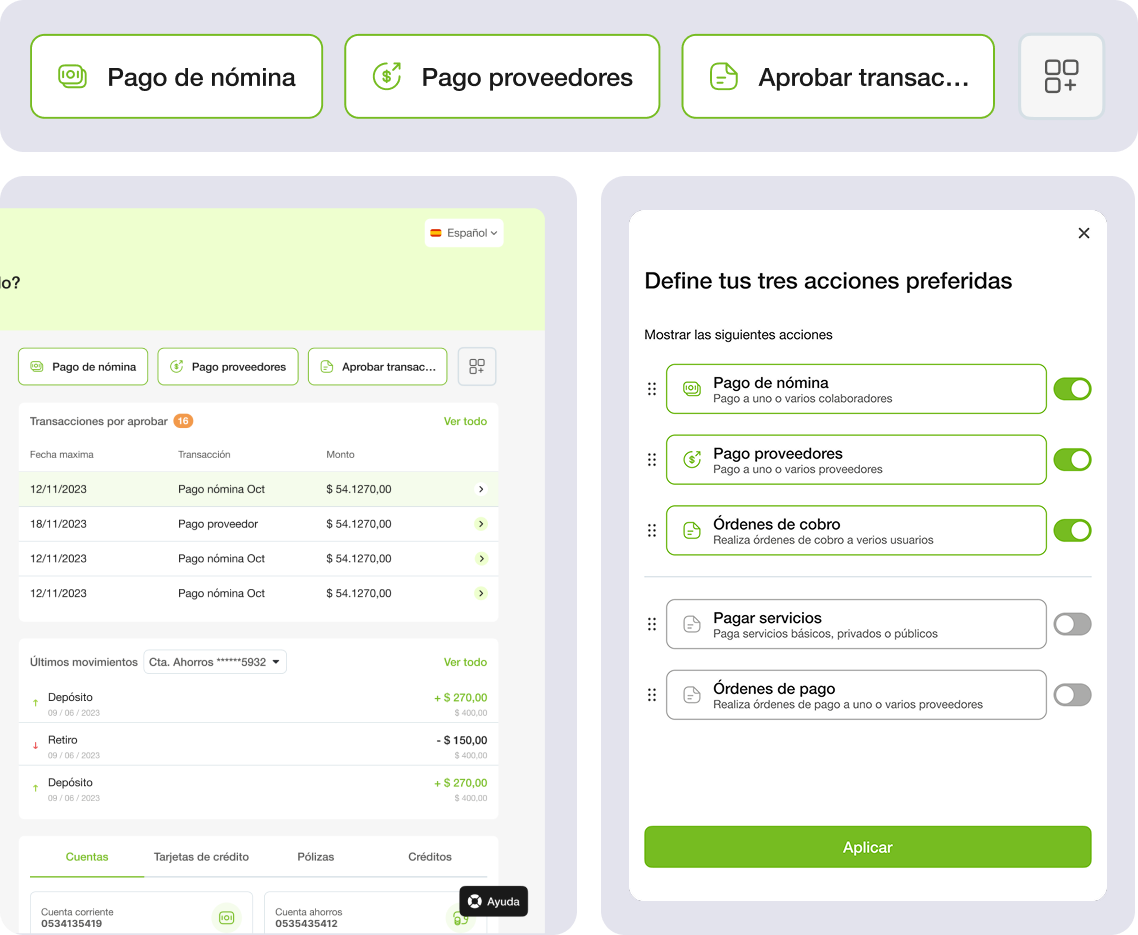

I restructured the site map to reduce complexity and clarify navigation by grouping related features, eliminating redundancies, and aligning sections with real business tasks. This resulted in a clearer hierarchy, fewer decision points, and faster access to high-frequency actions, especially in transactional and approval-heavy flows.

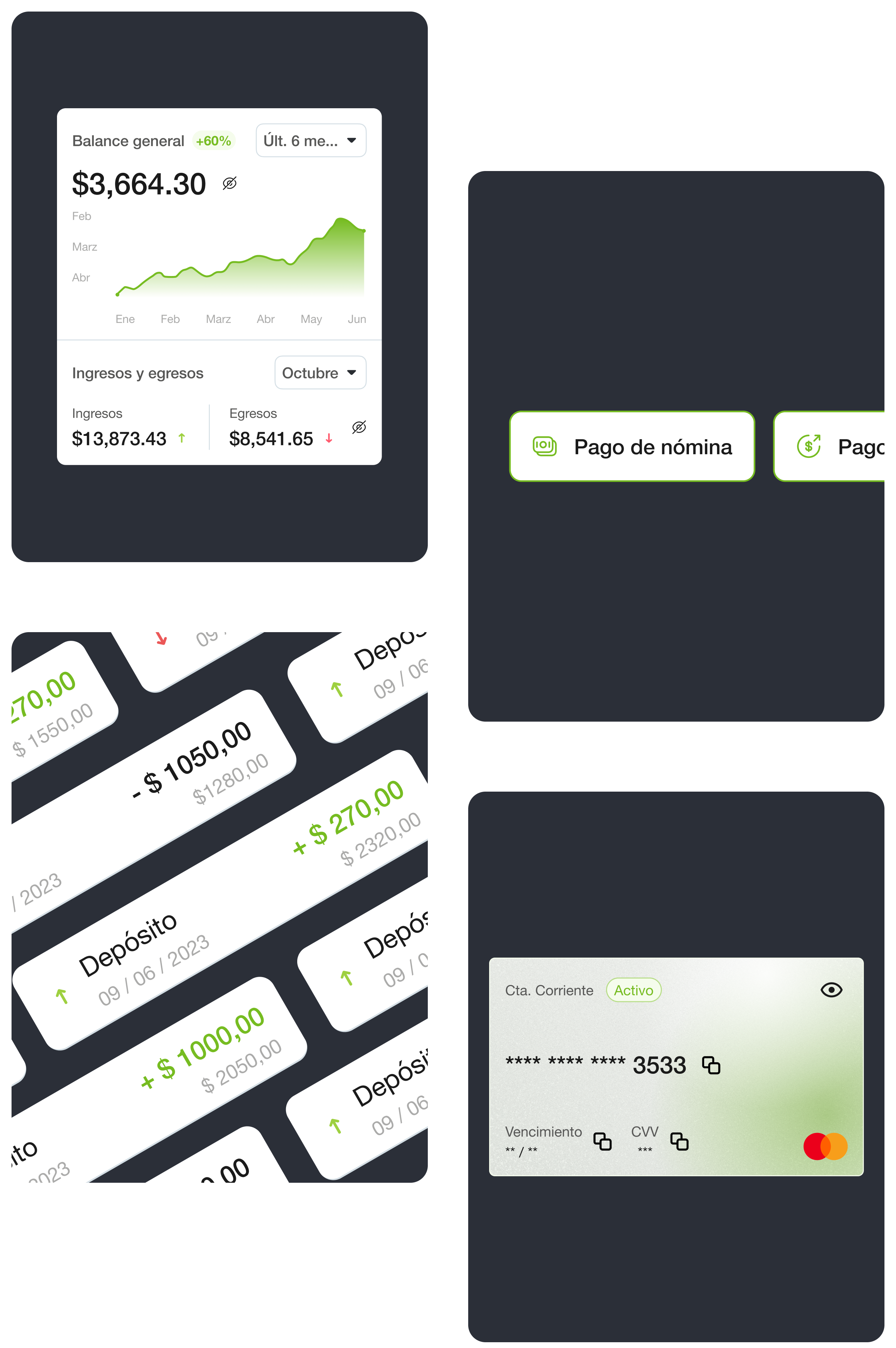

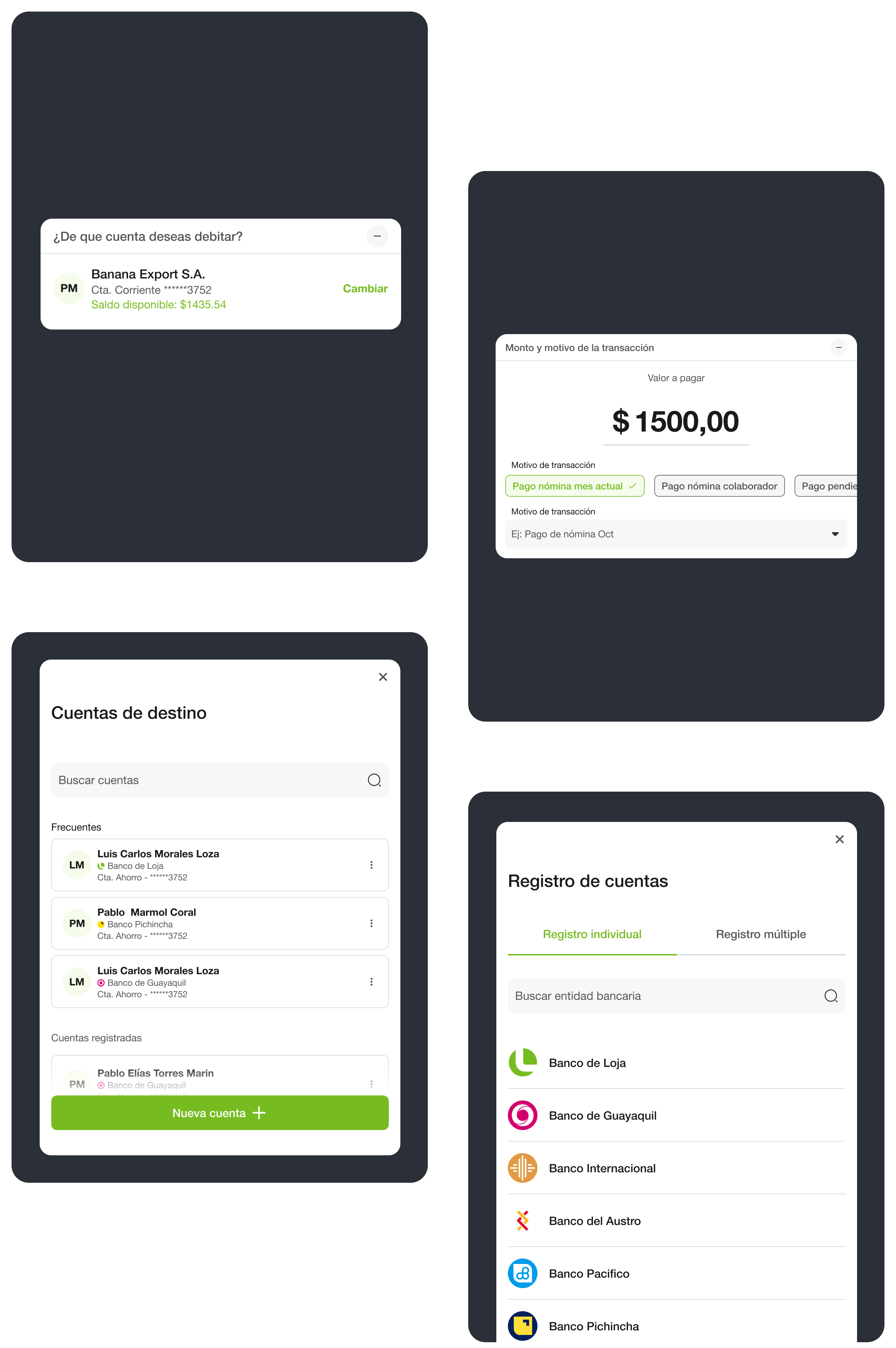

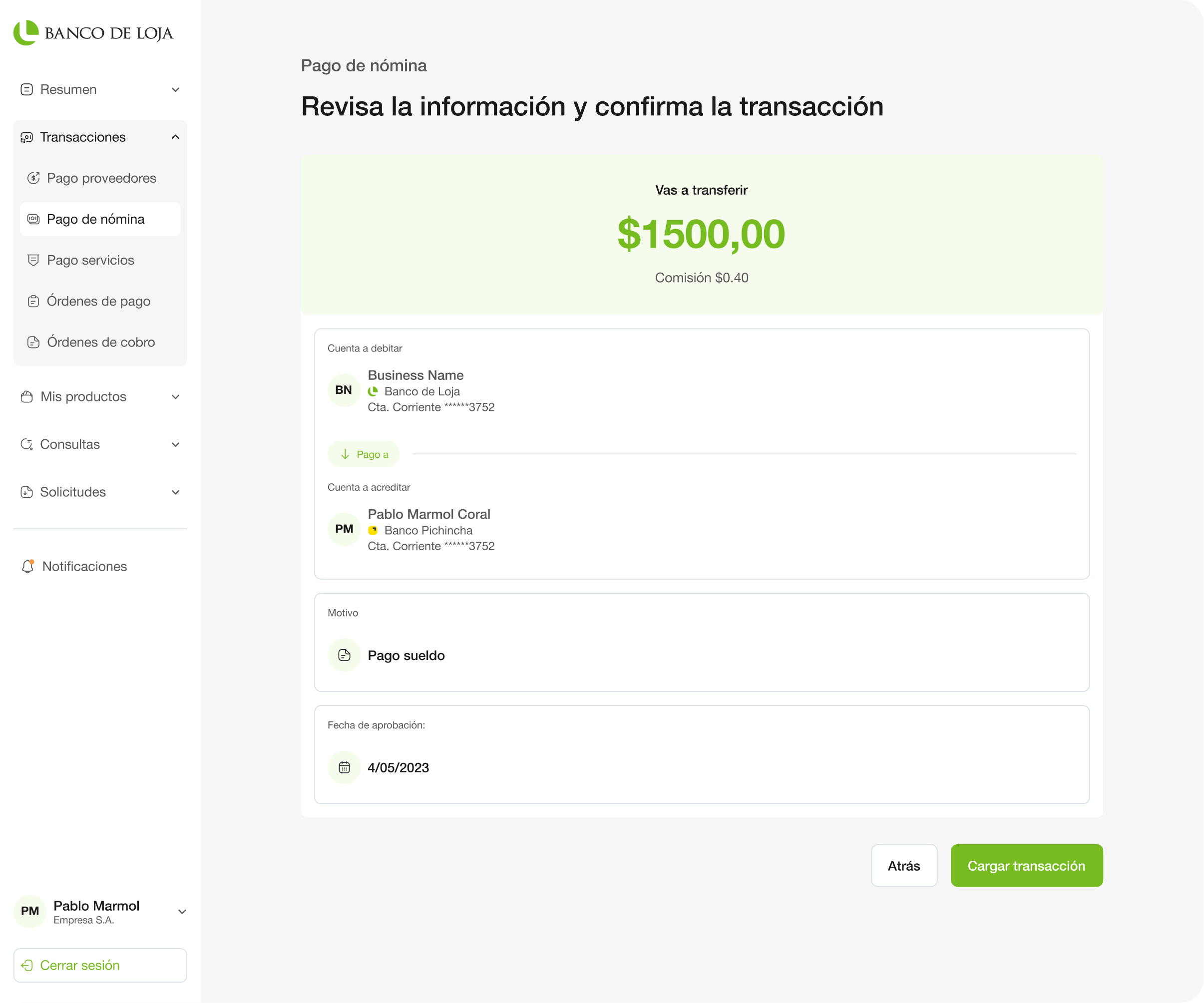

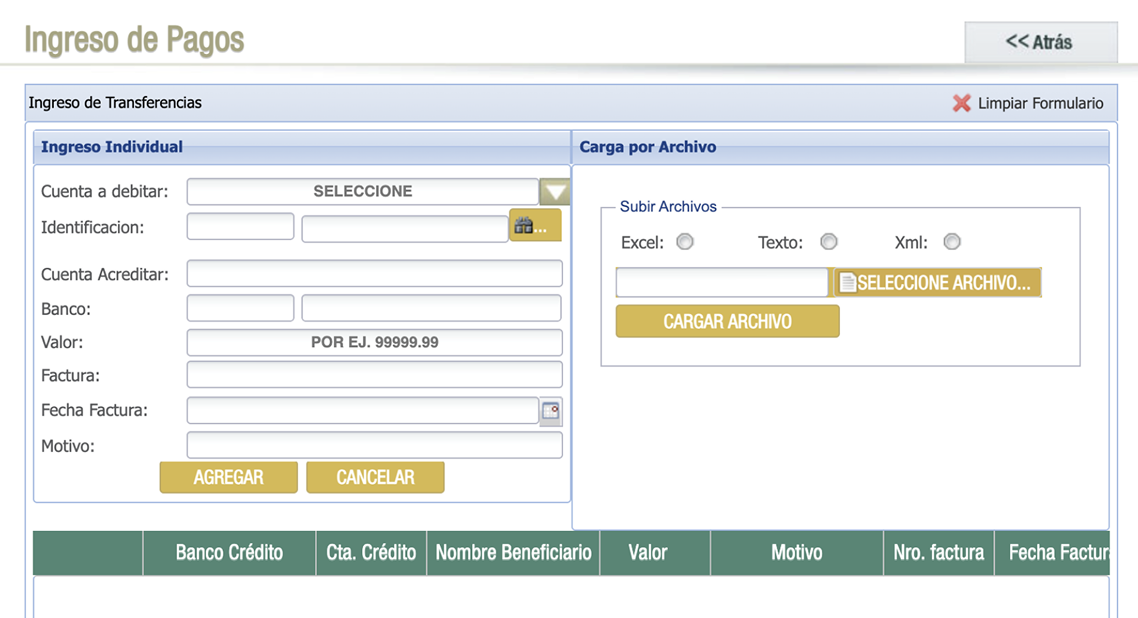

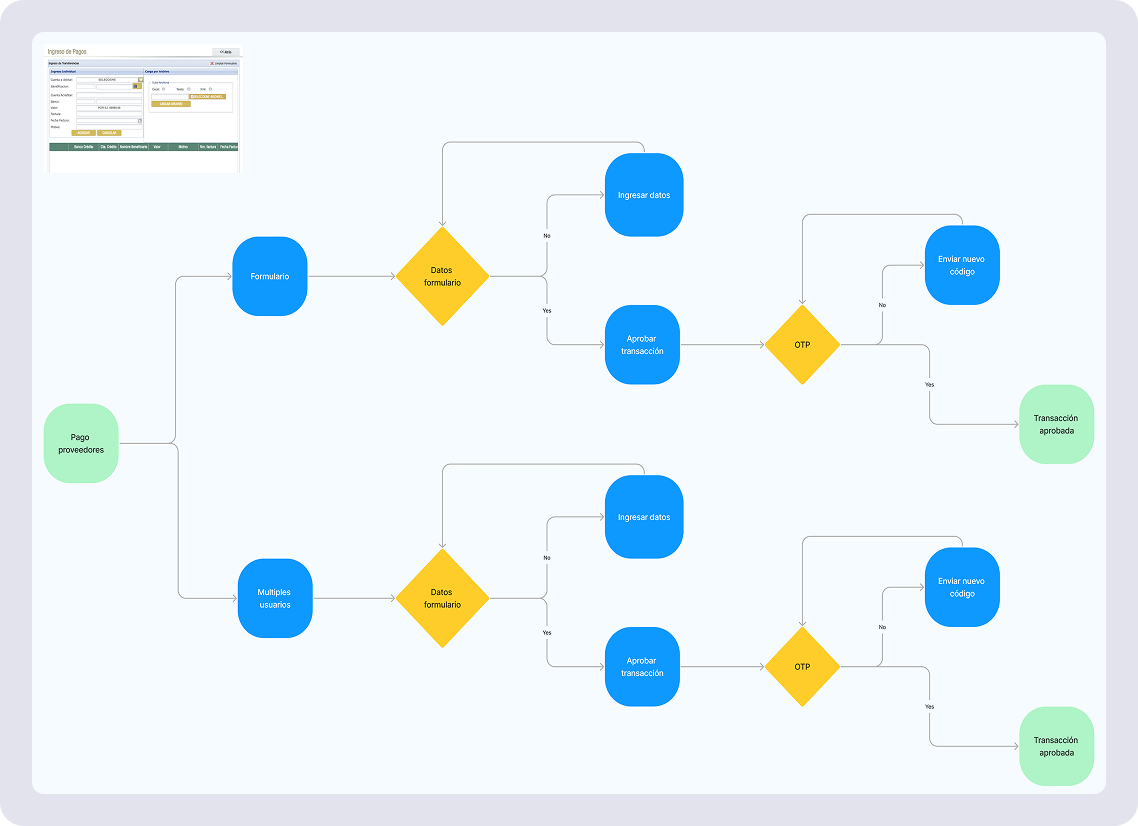

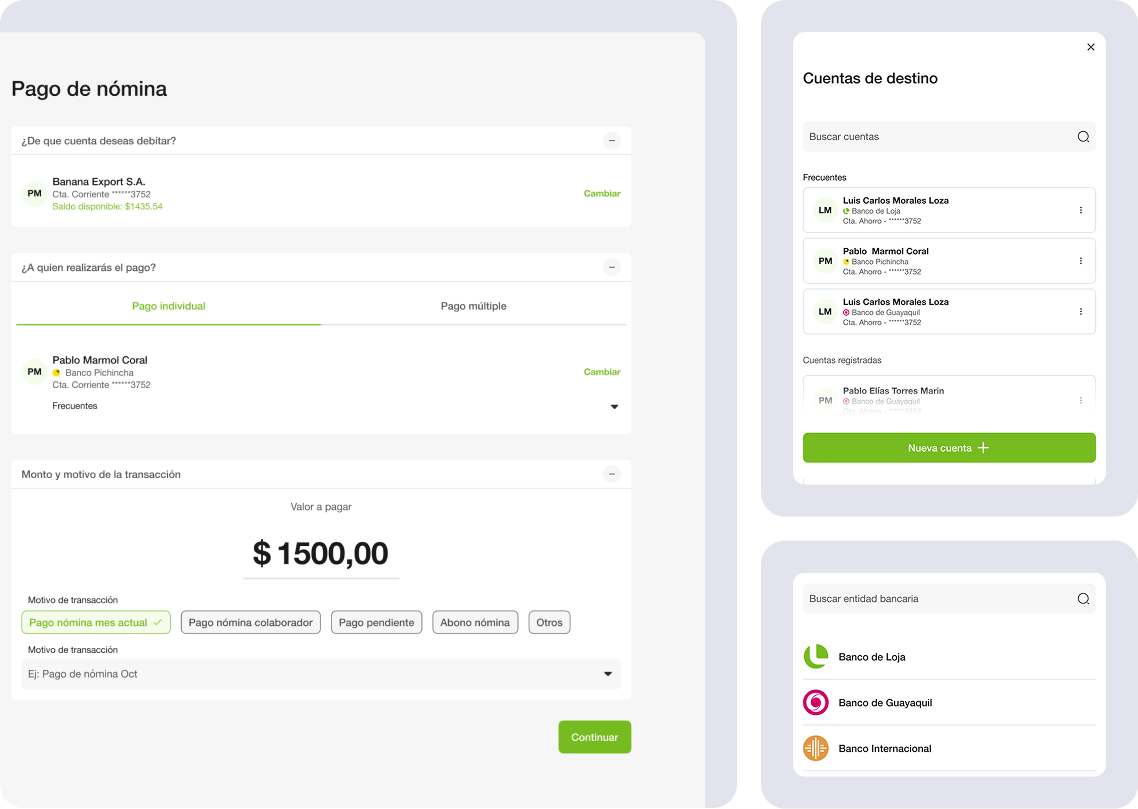

I mapped the most critical business actions (payments, transfers, approvals) and redesigned them to remove unnecessary steps, prioritizing speed and clarity.

Complex information was reorganized to show only what users need at each step, reducing overwhelm in high-stakes transactions.

Users can define their most frequent actions, allowing the platform to adapt to different business workflows rather than forcing a single rigid structure.

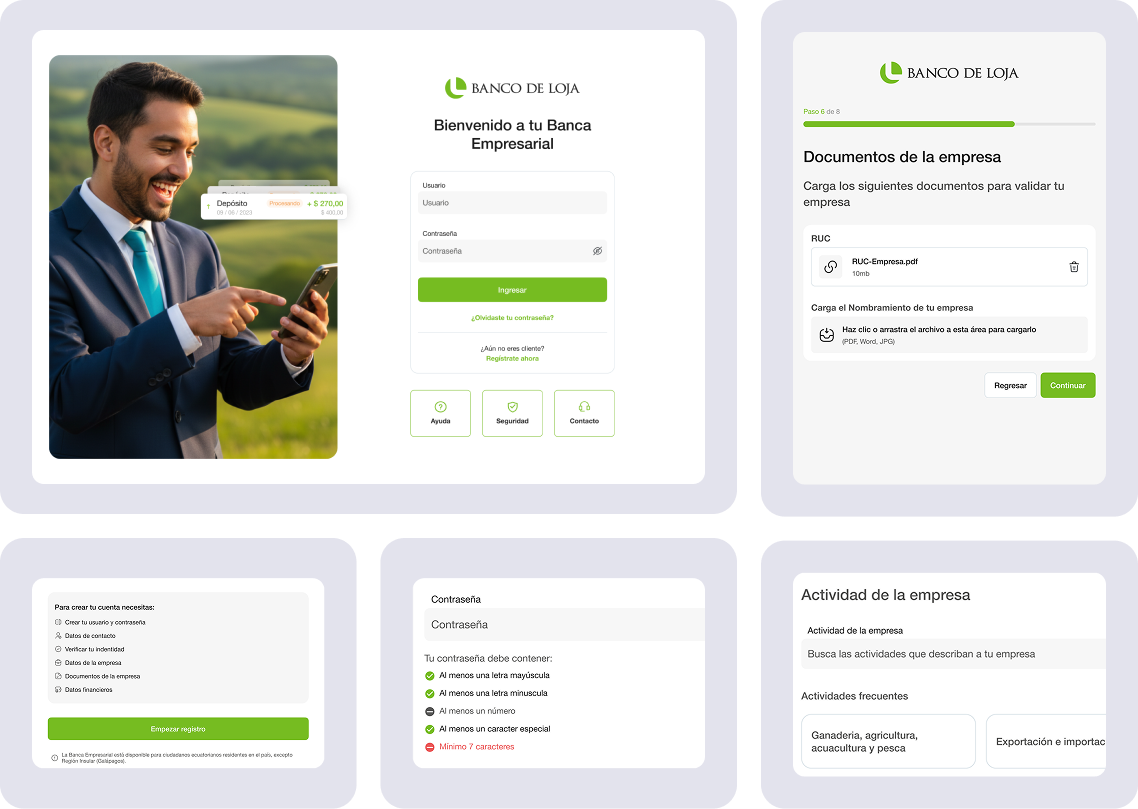

A complete onboarding flow was designed so users can register and start operating without visiting a physical branch, supporting scalability and remote usage.

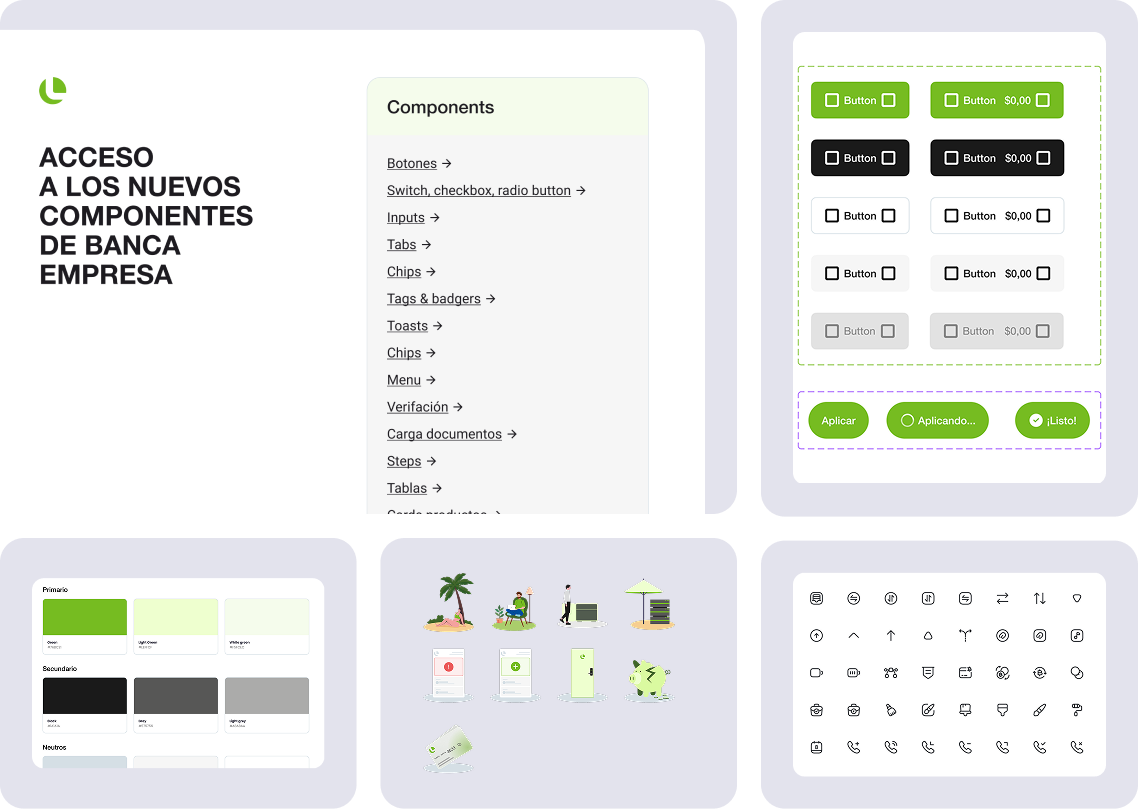

I designed a modular design system with reusable components, consistent interaction patterns, and clear visual hierarchy to support complex financial workflows. This system ensured consistency across the platform, reduced design and development friction, and enabled the product to scale efficiently as new features and services are added.